News

“Startup School 3” was presented at Azerbaijan Medical University

The next presentation session of the “Startup School 3” project was held at the Azerbaijan…

"Azexport" portal held a meeting at AzTU on "International e-commerce platforms…

Employees of the Azexport.az portal, operated by the Center for Analysis of Economic Reforms and Communication,…

Vusal Gasimli received the Malaysian Ambassador to Azerbaijan

Executive Director of the Center for Analysis of Economic Reforms and Communication (CAERC), Doctor…

İinnovative projects of CAERC will collaborate with the Chinese company Taovation

The representatives of the Center for Analysis of Economic Reforms and Communication (CAERC) held…

The info session of the "Startup School 3" project was held at Western Caspian University

The next info session within the framework of the “Startup School 3” project, organized…

The awarding ceremony of the winners of the "GIS-Tech Marathon 2025" took place…

The “GIS-Tech Marathon 2025,” organized in collaboration with the Center for Analysis of…

Op-eds

Agil Asadov

Head of the Strategic planning division

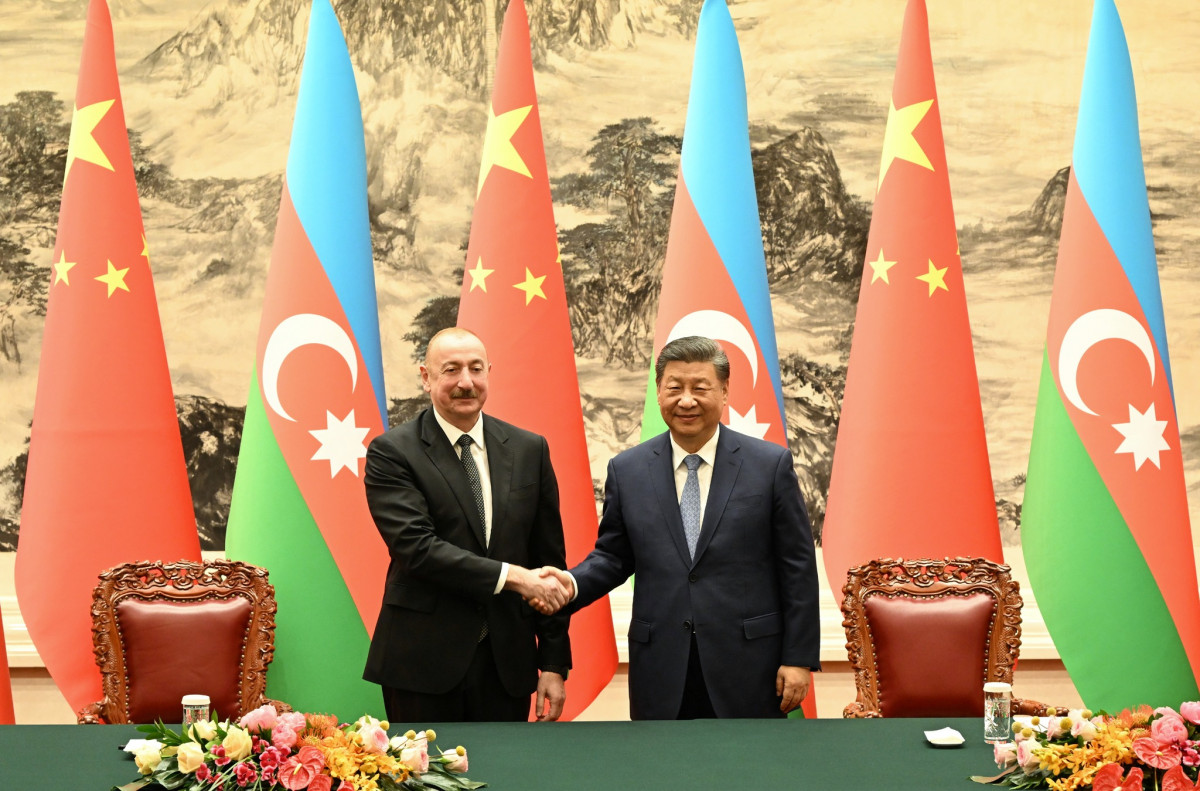

"Azerbaijan-China Relations: Formation and Perspectives"

Isa Gasimov

Head of the “Enterprise Azerbaijan” portal

Social entrepreneurship is an important tool for economic sustainability

Vusala Jafarova

Head of the Turkic World Research Center

"Driving Economic Integration and Digital Transformation: Azerbaijan’s Strategic Leadership in the Organization of…

Vusala Jafarova

Head of the Turkic World Research Center

"Azerbaijan’s Admission to the D-8: Strengthening Economic Cooperation with Global Potential"

Vusala Jafarova

Head of the Turkic World Research Center

Turkic States Economic Outlook for the First Half of 2024: Growth, Trade, and Investment Trends

Agil Asadov

Head of the Strategic planning division

Moody's: Growing influence of the Middle Corridor boosts economic prospects

Vusala Jafarova

Head of the Turkic World Research Center

The Karabakh Declaration and the future of economic cooperation of the Turkic world

Vusala Jafarova

Head of the Turkic World Research Center

"SCO Plus Summit: Catalyzing Economic Growth and Connectivity Among Turkic States"

Ayaz Museyibov

Deputy Executive Director of the CAERC

Azerbaijan and Türkiye: Leading through unity in global crises