The economic performance of the Turkic States Organization (TSO) member and observer countries has demonstrated robust growth and resilience during the first half of 2024. This analysis delves into the region’s economic trends, highlighting key metrics such as GDP growth, industry, agriculture, trade dynamics, investments, and fiscal policies. The data, drawn from the region’s economic activities, offers insights into the future trajectory of the Turkic states, emphasizing their strengthening position in the global economy[1].

Economic Growth and Performance

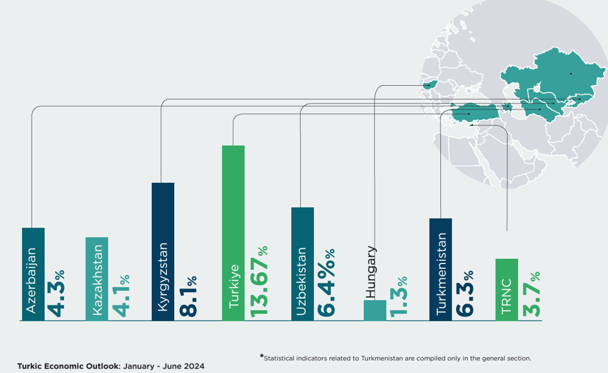

In the first half of 2024, the collective GDP of the Turkic states reached approximately $900.4 billion. This represents 1.7% of the global GDP forecasted at $54 trillion for the same period. The region’s economic growth rate was impressive, with an average increase of 5.98%, compared to the global average of 3.1%. The economic expansion in the Turkic states was nearly twice the global rate, underscoring the region’s dynamic development and growing economic influence. These figures highlight the continued strengthening of the Turkic states as an emerging economic bloc.

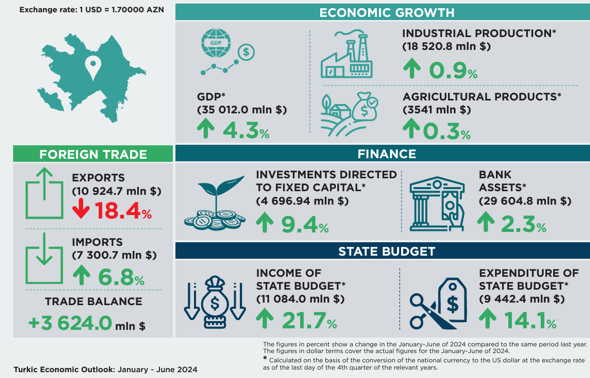

Turkiye, with a GDP of $594.9 billion, leads the Turkic states in economic size, accounting for the largest share within the organization. The country experienced a significant growth rate of 13.67%, positioning itself as a key driver of economic momentum within the region. Kyrgyzstan recorded a strong growth rate of 8.1%, followed by Uzbekistan at 6.4%. Other notable performers include Kazakhstan and Azerbaijan, with respective growth rates of 4.1% and 4.3%. These growth figures indicate not only the resilience of these economies but also their increasing integration into the global economic system.

Industrial and Agricultural Trends

The industrial production sector in the Turkic states displayed a mix of growth and contraction. Uzbekistan led the region with a 7.8% increase in industrial output. Kazakhstan followed with a 2.9% growth, while Azerbaijan and Kyrgyzstan recorded more modest increases of 0.9% and 1%, respectively. On the other hand, Turkiye’s industrial sector experienced a contraction of 1.55%, although it still maintained a significant output valued at $123.5 billion. The decline in Turkiye's industrial output reflects challenges within specific sub-sectors but does not diminish the overall importance of industry in its economy.

In the agricultural sector, Uzbekistan’s agricultural output grew by 3.8%, making it the top performer. Kazakhstan saw a 3.7% increase, while Kyrgyzstan and Azerbaijan registered more modest growth of 3.3% and 0.3%, respectively. Agriculture continues to play a crucial role in the economies of the Turkic states, contributing to food security and rural employment, while also offering potential for further modernization and investment.

Trade Dynamics and External Positioning

The total trade turnover among Turkic states in the first half of 2024 amounted to $508.8 billion, constituting 3.18% of the projected global trade turnover of $16 trillion. This robust trade activity reflects the growing economic integration of the region, as well as its expanding role in global supply chains and markets.

Kazakhstan achieved a positive trade balance of $11.6 billion, indicating a strong export performance. Turkiye, conversely, faced a trade deficit of $42.5 billion, a result of its high import demand driven by its large industrial sector. Uzbekistan and Kyrgyzstan recorded trade deficits of $5.8 billion and $4.4 billion, respectively, highlighting the challenges of balancing imports and exports in economies still transitioning toward higher value-added production.

As the Turkic states continue to expand their economic relations, the outlook for regional trade remains positive. The diversification of trade partners and the increased volume of intra-regional trade are expected to enhance the bloc’s standing in global trade networks in the years to come.

Investment Growth and Banking Sector Performance

In terms of investment, Kyrgyzstan led the region with an impressive 60.5% growth, signaling a strong inflow of foreign direct investment (FDI) and an increasingly favorable business environment. Uzbekistan also saw significant investment growth of 36.6%, while Turkiye recorded a 12.37% increase. Azerbaijan’s investment growth stood at 9.4%, reflecting stable investor confidence in its economy.

The banking sectors in the region also saw positive trends. Kyrgyzstan experienced a 31.7% growth in banking assets, the highest in the region, followed by Uzbekistan with 20%. Turkiye’s banking sector expanded by 16.57%, while Azerbaijan’s bank assets grew by 2.3%. These figures highlight the strengthening financial systems within the Turkic states, which are crucial for sustaining growth and attracting further investments.

Fiscal Trends: Budget Revenues and Expenditures

In terms of fiscal policy, Turkiye and Azerbaijan saw significant increases in budget revenues, with 26.34% and 21.7% growth, respectively. However, Turkiye's public spending grew at a higher rate of 20.11%, indicating a focus on fiscal expansion to support economic development and infrastructure projects.

Kazakhstan demonstrated stability in its fiscal management, with both revenues and expenditures increasing by 4%. This reflects a balanced approach to budgeting, maintaining fiscal discipline while supporting economic growth. Uzbekistan’s budget revenues grew by 18.3%, with more moderate growth in expenditures, signaling a controlled approach to public spending. Kyrgyzstan’s budget revenues increased by 24.7%, but expenditures were limited to a 6% growth, indicating a cautious fiscal policy aimed at maintaining financial stability.

Strategic Considerations for Future Growth

The Turkic states are well-positioned for continued economic growth due to their robust industrial, agricultural, and trade sectors. The data suggests that the region’s economic potential lies in its ability to attract investment, expand trade, and maintain stable fiscal policies. Strategic approaches to enhancing infrastructure, diversifying industrial output, and improving governance will be critical in unlocking further growth opportunities

Furthermore, increasing cooperation between the member and observer states of the Turkic States Organization, coupled with targeted policies to boost innovation and technology, will play a crucial role in shaping the future economic landscape. The ongoing trend of investment in human capital and infrastructure development positions the Turkic states for sustainable long-term growth.

The Turkic states continue to exhibit strong economic performance, outpacing global growth averages in several key areas. With expanding trade, rising investments, and positive fiscal policies, the region’s economic outlook for the second half of 2024 and beyond appears promising. By strategically focusing on sectors like technology, industry, and agriculture, and by fostering greater economic integration within the region, the Turkic states are poised to strengthen their position on the global stage.

The economic trends of the Turkic states suggest a resilient and evolving region that will likely play an increasingly pivotal role in the global economy.

Most readed news

A discussion was held on the monitoring of the State Program on the Geological Study of the…

The awarding ceremony of the winners of the "GIS-Tech Marathon 2025" took place…

The first meeting on simplifying air transportation formalities was held at CAERC

"Azexport" portal held a meeting at AzTU on "International e-commerce platforms…

Azerbaijan-Iran relations: from the past to the future

Employees of the "Enterprise Azerbaijan" portal met with a professor from Stanford…

An info session was held at Baku State University as part of the "Startup School 3"…

Call for co-authors “Turkic States: Rising Investment Powerhouses” Book

The Head of the TWRC delivered a presentation at an international conference in Tashkent

The "Startup School 3" project was discussed