THE EQUILIBRIUM REAL EXCHANGE RATE IN A COMMODITY EXPORTING COUNTRY: AZERBAIJAN'S EXPERIENCE

Prof. Dr., Vusal GASIMLI[1], Executive Director, Center for Analysis of Economic Reforms and Communication, Baku, Azerbaijan

Ph.D. student, Vusala JAFAROVA[2], Institute for Scientific Research on Economic Reforms, Baku, Azerbaijan

ABSTRACT

The case of Azerbaijan serves to study the adequacy of exchange-rate policy in a resource-rich economy. This paper analyses the behaviour of Azerbaijan’s external accounts over the past twenty years. Declining oil prices made an existing exchange-rate peg unsustainable and led to a large devaluation in 2015. Since then, the current account balance has improved, but by less than expected. We use the EBA-Lite method to derive regression-based estimates of the equilibrium real exchange rate, and relate misalignments to measures of “policy gaps”. Our findings suggest that only a few years after the devaluation, Azerbaijan’s currency has once more become overvalued. Moreover, the equilibrium real exchange rate is volatile and hardly compatible with a long-run exchange rate peg. Exchange rate policy should try to accommodate shifts in the fundamental determinants such as relative productivity and real oil prices.

KEYWORDS: Equilibrium real exchange rate; CA gap and REER gap; EBA lite model, Azerbaijan economy.

1. INTRODUCTION

The study analyzes the exchange rate policy of Azerbaijan, the real exchange rate, its relationship with the main determinants that affect it, and assesses the level of equilibrium of the national currency exchange rate for the current and future periods.

We note that,in Azerbaijan, current account (CA) and real effective exchange rate (REER) moved depending on oil prices over last decade. External position improved in 2019 due to higher oil prices and lower oil-related services imports. Despite a large current account surplus the external position was weaker and external stability risks were mitigated by sizable foreign exchange reserves. The CA surplus was 12.9 % and 9% of GDP in 2018 and 2019 respectively. In 2019, exports of the non-oil sector increased by 14% compared to 2018 which is not considered a weak increase by percentage. It was expected that in the short term, the overall CA surplus to decline to 10 percent of GDP due to lower oil prices and the impact of the recent appreciation of the real effective exchange rate (REER).

The EBA-Lite methodology applied in this article include both deterministic and probabilistic assessment of external sustainability. The model decomposes estimated current account (CA) and REER gaps into a policy, a shock, and an unexplained (residual) component. On the policy gaps, the EBA framework demonstrates the estimation results for the current account regression for Azerbaijan. The coefficients from the estimation of the current account regression are obtained from a panel regression.

Two stages of the regression-based methods are conducted. The first stage focuses on understanding current account and real exchange rate developments, via the estimation of panel regressions and the second stage provides estimates for normative evaluation of current accounts and real exchange rates and estimates the contributions of “policy gaps” to current accounts and real exchange rates.

Model also investigates the presence of a long-run cointegrating relationship between the real exchange rate and certain explanatory variables, estimates the speed at which the real exchange rate converges toward its equilibrium level, and assesses the gap between the actual and the equilibrium real exchange rate levels.

Model-derived estimates of the long-run equilibrium real exchange rate replicate most recognized periods of currency overvaluation in Azerbaijan. This concludes that an appreciation in 2019 were consistent with developments in its fundamental determinants.

The results of this study imply that, although Azerbaijan should continue with a managed float, targeting a constant REER over a prolonged period is not warranted as such a policy does not accommodate real shocks by allowing the nominal exchange rate and/or relative prices to move. Exchange rate policy should be directed to align the real exchange rate with its fundamental determinants, namely relative productivity and real oil prices.

The results of the EBA-lite regression-based model point to overvaluation of the manat. estimated CA and REER gaps point to a weaker external position. Azerbaijan needs to bring its level of healthcare spending closer to EM average over the medium term, and promote financial deepening.

Existing models to estimate long-run movements in real exchange rates (RER) provide mixed results. The most used simple purchasing power parity (PPP) hypothesis demonstrated itself as a weak model of the long-run real exchange rate. According to Dornbush (1982) and others a constant real exchange rate rule, based on the notion of purchasing power parity, targets keeping the real exchange rate constant at a level prevailed in some base period, Also, the results of time-varying models that try to understand the relation between economic fundamentals and real exchange rate behavior were controversial, with many studies failing to find a robust relationship between the real exchange rate and its determinants. A recent study by Cashin, Céspedes, and Sahay (2002) developed a long-run equilibrium exchange rate model for commodity - exporting countries and found that in many commodity-dependent low-income countries real commodity export prices and real exchange rates move together in the long run [2].

Later on, Choudhri and Khan (2004) found that Balassa-Samuelson effects are relevant for developing countries and the terms of trade have influence on the real exchange rate. IMF developed method of EBA-lite model which is used in External Balance Assessment studies [1].

In the case of Azerbaijan, the terms of trade (the oil price) are likely to be an important fundamental factor for the equilibrium RER. Another one is the fiscal stance. There is little agreement on which method is superior, and the topic of exchange rate assessment is a hotly debated one. Economists often do not even agree on how to measure the real exchange rate. Some take the REER approach, others compare prices of tradable to non-tradable goods in the domestic markets. It is observed that, it does not pay off to be too precise in calculating the REER. In most cases, 5 partner countries are sufficient, additional ones do not change the picture much.

In this paper, the IMF EBA lite model was applied to Azerbaijan. Since 1994, the authorities aimed at maintaining a stable real effective exchange rate (REER) against a basket of currencies weighted on the basis of the trade shares of Azerbaijan’s main trading partners . However, the REER varied continuously over the last decade. This study finds evidence for the existence of a time-varying equilibrium real exchange rate in Azerbaijan. The EBA-lite model together with real oil prices (i.e., the terms of trade) explain the long-run equilibrium REER. Hence, other models are also applicable for the case of Azerbaijan. The low productivity growth in the non-hydrocarbon sector was the main factor behind the equilibrium real exchange rate over the last twenty years. Moreover, the analysis shows that the REER was close to its equilibrium level during this period.

The remainder of the paper is organized as follows. After briefly describing the evolution of the Azerbaijan exchange rate regime in Section II, Section III reviews the existing literature on the equilibrium real exchange rate. Section IV uses different models to determine the long-run equilibrium real exchange rate. First, it tests the EBA-lite hypothesis. Then, it investigates the presence of a long-run cointegrating relationship between the real exchange rate and certain explanatory variables, estimates the speed at which the real exchange rate converges toward its equilibrium level, and assesses the gap between the actual and the equilibrium real exchange rate levels. Section V is the conclusion of findings of study.

2. LITERATURE REVIEW

There are different approaches related to determining equilibrium exchange rate in the literature. The concept of Purchasing Power Parity (PPP) (Gustav Cassel, 1918) is often the first port of call for economists and market analysts who wish to estimate the equilibrium real exchange rate. PPP implies that the real exchange rate will revert to its mean, although it may deviate from its mean for several years at a time. The most widely used methodology to confirm or reject PPP is based on the analysis of the time series properties of the REER, which is assumed to measure changes in price level differences between a country and its trading partners (Rogoff, 1996). If the REER series is stationary and the speed of convergence of the REER towards its mean is fast enough, then PPP can be considered to hold. Slow convergence is inconsistent with PPP, which only allows for short-term deviations from equilibrium.

PPP has proven to be a weak model of the long-run real exchange rate. Most studies have failed to find cointegrating relationships that are consistent with PPP (or, equivalently, consistent with a stationary real exchange rate). Meese and Rogoff (1983) demonstrated that a variety of linear structural exchange rate models failed to forecast more accurately than a random walk model for both real and nominal exchange rates. A well-known problem with PPP is that it fails to take into account that the equilibrium real exchange rate, defined as the price of tradable goods relative to nontradable goods that is consistent with both internal and external balance, is itself an endogenous variable that is likely to change over time in response to a variety of disturbances. Recent work has therefore emphasized the time-varying nature of the long-run real exchange rate. The equilibrium real exchange rate is not a single rate, but a path of real exchange rates over time that is affected by the current and expected values of variables that affect internal and external equilibrium. These variables are known as fundamentals. Williamson (1985) developed a methodology to calculate the equilibrium exchange rate, which is consistent with the macroeconomic balance and he identified this rate as the Fundamental Equilibrium Exchange Rate (FEER). The multitude of potential fundamentals offered by researchers in their attempts to solve the PPP puzzle include the Balassa-Samuelson effect government spending, cumulated current account imbalances, and real interest rate differentials as important drivers of long-run deviations from purchasing power parity (see Froot and Rogoff (1995) and Rogoff (1996)). Clark and MacDonald (2000) extended the approach to better differentiate between permanent and transitory components of the real exchange rate [1].

Several models have been developed to determine the equilibrium real exchange rate in developing countries. Edwards (1989, 1994) made a seminal attempt to build an equilibrium real exchange rate model specifically tailored to developing countries by exploring the long-run co-movements of the real exchange rate with variables such as the terms of trade, productivity, net foreign assets, the fiscal balance and measures of openness of the trade and exchange system. Khan and Ostry (1991) provided panel data estimates of the elasticity of the equilibrium real exchange rate with respect to terms of trade shocks and commercial policies in a static model.

The connection between economic fundamentals and exchange rate behavior has also been controversial. Many studies have failed to find a statistical link between real exchange rates and fundamentals. Edison and Melick (1999) failed to find cointegration between real exchange rates and real interest rate differentials, and Rogoff (1996) found a mixed empirical track record of the Balassa-Samuelson effect on real exchange rates. Recent efforts to confront these challenges have explored new approaches on both theoretical and empirical fronts, including incorporating non-linearity in modeling exchange rate dynamics.7 Alternatively, it has also been recognized that if one could find a source of real shocks that is sufficiently volatile, one could potentially go a long way towards solving these major empirical exchange rate puzzles. In this respect, Chen and Rogoff (2002) found for four commodity-exporting developed countries that the dollar price of commodity exports exhibits a strong influence on real exchange rates. Similarly, Cashin et al [2]. (2002) show that in many commodity-dependent low-income countries, the real price of commodity exports and real exchange rates move together in the long run. Furthermore, Choudhri and Khan (2004) found strong evidence of Balassa-Samuelson effects in developing countries [1].

Literature on policy circles are increasingly emphasizing probabilistic models of debt sustainability, thus e.g. the ECB debt assessment framework (Bouabdallah et. al., 2017; IMF, 2018; Rozenov, 2017; and Barrett, 2018). More revised approach is the one suggested in Blanchard and Das (2017), and well-suited to settings i.e. forecasts assume constant exchange rates. This framework, net external liabilities are considered sustainable if there is a high enough probability that, at the current exchange rate, they are equal to or less than the present value of net exports, and plus the rate of return differential times the gross asset position.

The External Balance Assessment (EBA) methodology was developed in 2012 by the IMF’s Research Department (RES) to replace the Consultative Group on Exchange Rate (CGER) methods (Lee et al., 2008).‘Compared to CGER, EBA makes a distinction between positive analysis of current account and real exchange rate and normative assessments, and emphasizes the roles of policies and policy distortions. EBA models include a broader set of fundamentals to have a better positive (descriptive) understanding of current account and real exchange rate; and differentiate policy variables from non-policy fundamentals to explicitly include policy gaps in normative assessments.

This literature of EBA framework includes the work on the predecessor to EBA (Lee et al. (2008)), and Blanchard (2007), Chinn and Prasad (2003), Chinn, Eichengreen, and Ito (2007, 2011), Debelle and Faruqee (1996), de Santis, Finicelli, and Veronese (2011), Gruber and Kamin (2007, 2008), and Bussiere et al. (2010). Araujo et al. (2013), Beidas-Strom and Cashin (2011), Bems and de Carvalho Filho (2009a), and Catao and Milesi-Ferretti (2013) [1].

The literature on exchange rate determinants is broad and not attempted to summarize them all here. However, to note that standard contributions include Bayoumi et al. (2005), Bems and de Carvalho Filho, (2009b), Cashin, Céspedes, and Sahay (2004), Christiansen et al. (2009), Lee et al. (2008), Ricci, Milesi-Ferretti, and Lee (2013) [2].

3. TASK STATEMENT

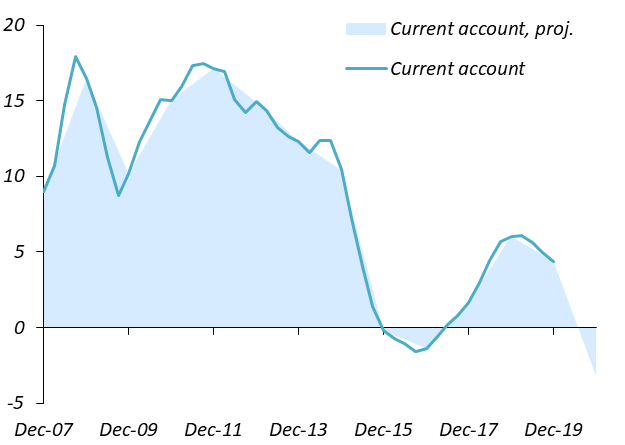

The exchange rate of the Azerbaijan manat was pegged to a basket of currencies in which the U.S. dollar was assigned a relatively large weight due to its importance in hydrocarbon export receipts and debt-service payments. The current account surplus made 9.2 percentage of GDP in 2019 (Figure 1). Despite higher financial outflows, international official reserves of the Central Bank of Azerbaijan (CBA) and the Oil Fund (SOFAZ) rose to $44 billion (98 percent of GDP).

Figure 1 . External current account, in billions USD.

Oil prices decline by more than half cause large losses in hydrocarbon revenue. At an average oil price of 35 U.S. dollar per barrel, current account balance could turn from a surplus of 9 percent of GDP in 2019 into a deficit of 8 percent of GDP in 2020. The deterioration would be even worse since tourism receipts and remittances decline sharply as a consequence of the covid-19 crisis.

In 2015, Azerbaijan’s economy experienced the reverse oil shock, and the government responded to the dramatic erosion of export revenue. The economy expanded by 2.3 percent in 2019, and with declining imported food prices under a de facto ER peg, and remaining excess capacity, inflation fell to 3 percent in 2019 (from 13 percent (y/y) in 2017).

Azerbaijan's Real Effective Exchange Rate data is updated monthly and averaged 190.1 from Jan 2005 to Dec 2019. The data reached an all-time high of 190.1 in Jan 2015 and a record low of 94.5 in Jan 2005.[3]

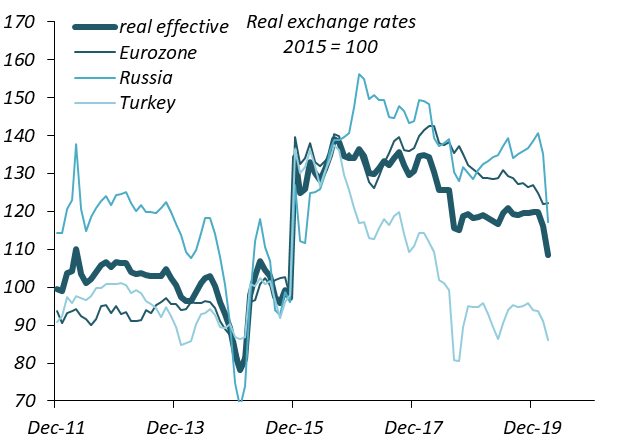

Figure 2. Real exchange rates, 2015 = 100

Azerbaijan is only neighbor with a hard exchange rate peg when its neighbors Russia, Turkey, Georgia and Iran let their currencies fluctuate and depreciate. The euro also depreciated vis-à-vis the U.S. dollar. This leads to trading partner prices to decline as measured by the real effective exchange rate (figure 2). Relative prices of Russian goods fell most with 12 percent and imported deflation keeps domestic price increases low in Azerbaijan.

Since January 2018, the CBA reduced its refinancing rate from 15 to 8¼ percent and narrowed the interest rate corridor to +/-2 pps around the refinancing rate. Manat base and broad money expanded, and excess liquidity remained ample. However, since inflation fell faster than nominal interest rates, real interest rates have risen. With the ER fixed at AzN/US$ 1.70 since April 2017 and trading partner currencies depreciating, the nominal and real effective ERs appreciated (by 5–7 percent in 2018), further tightening financial conditions.

Qlobalization and international trade increases competitiveness of a country’s economy, export potential and efficient domestic production. Trade in goods and assets drives development of input factors and supports growth of potential GDP over long term. Azerbaijan has great potential to benefit from international trade to increase income and wealth as a developing country however integration with global economy entails risks of openness. Therefore, globalization implies to build capacity to manage risks occuring from trade flow especially against volatile international financial flows. It requires to follow the standard three step procedure in managing external balance. The first is setting a policy target on the stock of foreign reserves. The second is assessing realism of reserve target under current trends and policies enabling to identify external financing gap and predictability and forecast of balance of payments. The third is quantifing external adjustment needs.

As an oil exporter country, Azerbaijan economy is integrated with the world economy which means more exposure to economic events or shocks which originate in those world markets outside the country itself. In this article we will strife to gauge the country's position in the global economy by using data on value of goods and services the country buys from or sells to the rest of the world, namely, net exports and external financial linkages. We will also review implications for a current account deficit or surplus and arrive at some notion of an appropriate current account balance, a current account norm. Then, we'll analyse the real exchange rate (RER) which gives important information to market participants regarding the mix of foreign versus domestic goods on both the production and the purchasing side.

In this article we will analyze a relation between the trade balance and RER, also the adjustment need of the real exchange rate into one of the nominal exchange rate. External adjustment is accomplished by changing relative prices of foreing goods- the real exchange rate, which has impacts on other sectors as fiscal and monetary. For example, raising RER reduces the demand for imports and improves trade balance, also increases private savings.

In Azerbaijan, current account (CA) and real effective exchange rate (REER) moved depending on oil prices over last decade. External position improved in 2019 due to higher oil prices and lower oil-related services imports. Despite a large current account surplus the external position was weaker and external stability risks were mitigated by sizable foreign exchange reserves. The CA surplus was 12.9 % and 9% of GDP in 2018 and 2019 respectively. However nonoil CA balance worsened due to increase in non-oil imports and slow growth in non-oil exports. It was expected that in the short term, the overall CA surplus to decline to 10 percent of GDP due to lower oil prices and the impact of the recent appreciation of the real effective exchange rate (REER). The country’ overall reserve coverage is more than adequate according to the IMF’s Assessing Reserve Adequacy (ARA) metric.

4. DESIGN AND METHODOLOGY

The EBA-Lite methodology developed by IMF under the guidance of Olivier Blanchard and Jonathan D. Ostry includes both deterministic and probabilistic assessment of external sustainability. The model decompose estimated current account (CA) and REER gaps into a policy, a shock, and an unexplained (residual) component (IMF, 2016 and 2019). The policy component of the model indicates how much external positions reflect deviations of policies (P) from their desirable levels (P*). Model provides guidance on setting P*s for all seven EBA-Lite policy variables: fiscal policy, public health expenditure, the level of private credit, change in private credit, foreign exchange intervention (FXI), capital controls, and real short-term interest rate. For some policy variables (i.e., the level of private credit; and public health expenditures), the model guides to estimate benchmark levels in setting desirable levels. The role of capital controls in influencing the relation between level of development and the current account was highlighted by Reinhardt, Ricci, and Tressel (2010), who show that accounting for capital controls can help explain the Lucas Puzzle

EBA comprises three methods: i) two methods are panel regression-based analyses of the current account and real exchange rate, and ii) the third method is model-free and focused on sustainability analysis. EBA takes into account a set of factors including policies, cyclical conditions, and global capital market conditions influencing the current account and real exchange rate.

Two stages of the regression-based methods are conducted. The first stage is descriptive, and focuses on understanding current account and real exchange rate developments, via the estimation of panel regressions. And the second stage provides estimates for normative evaluation of current accounts and real exchange rates and estimates the contributions of “policy gaps” to current accounts and real exchange rates.

The basic framework behind the EBA empirical analysis is two relationships: i) the first expresses the current account as the gap between aggregate saving and investment (the so-called “IS” relation); and ii) the second equation comes from the balance-of-payments (BOP) relation. It should be noted that in the second equation, ΔR is taken as exogenous (policy determined), and so is not written as a function of any other variable.

It should be noted that estimating the CA as a function of REER and other variables would be inappropriate (as would estimating the REER as a function of CA), since the system above implies that CA and REER are both endogenous and simultaneously determined as a function of other variables. However, the theoretical framework suggests that most factors that would influence the current account would also influence the RER, and vice versa. While the REER is an essential part of the process of adjustment of the CA, via its expenditure switching role, the REER is not itself an exogenous driver of the CA.

Another implication is a rough proportionality that is observed between the two coefficients estimated on the same variable in the separate CA and REER regressions. In other words, a factor found to lower the CA by 1 percent of GDP will typically be found to raise (appreciate) the REER, by around 3-5 percent. This pattern could be expected, due to a reflection of the expenditure-switching role of REER movements.

In EBA framework, a different approach is chosen for policy and non-policy variables, i.e. policy variables, do not include regressors that are statistically insignificant and critera for policy variables are relatively stringent. However, for non-policy variables these are included as regressors even if not statistically significant as long as the coefficients have the correct sign. To sum up, most regressors in the final specification are statistically significant.

It should be noted that theory does not imply a simple correspondence and proportionality of effects on the CA and REER for all variables. Interest rates is expected to have a clear, but temporary, effect on RER, however would have two opposing effects on the CA. Higher interest rate would also temporarily appreciate the REER, and in turn have a negative effect on the CA through the expenditure switching channel. It will also reduce domestic demand and boosting the CA.

Thus, the net effect on the CA would be unclear, and even not empirically detectable which implies that interest rates are highly significant in the REER regression but it is not the case for all in the CA regression. To sum up, broader theoretical frameworks suggest some factors indeed may influence the real effective exchange rate without any clear implication for the current account. Other determinants, like a permanent gain in the terms of trade, and in productivity of tradables relative to nontradables, also possible to boost real income and wealth, and doing so appreciate the REER, but again without any clear implication for the level of the current account.

It is fact that, economy’s current account and real effective exchange rate is measured relative to other countries. Hence they cannot be determined only by a country’s own characteristics which implies also to reflect foreign characteristics, and simultaneously determined in general equilibrium.

- Elasticities and responses to changes in the real exchange rate

If the real exchange rate depreciates, imports become more costly and the value of imports may rise. The volume effects are large enough to dominate the price effect known as the Marshall-Lerner condition. The Marshall-Lerner condition does hold in the long run, but it may not hold in the very shortest of short runs when imports and exports tend to have very inelastic responses.

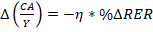

To summarize the effect of the real exchange rate on the current account in an equation[4]:

∆CAY=-η*%ΔRER (1)

(1)

The parameter “eta” indicate the response of the current account to GDP as a function of the percentage change in the real exchange rate. For example, if eta is equal to 0.17, this means that if we have a 1% appreciation of the real exchange rate, the current account will deteriorate by 0.17% of GDP. Or, if the response of CA/Y to a one percent depreciation of the real exchange rate is estimated as 0.5 and the real exchange rate depreciates by 5%, then the current account increases by 2.5 percent of GDP.

- External Balance Assessment (EBA) framework

EBA method plays a central role in the diagnostic of a country’s exchange rate and allows to assess whether a country’s exchange rate is in line with macroeconomic fundamentals. The EBA method is composed of three approaches: 1. The Current Account (CA) approach; 2. The Real Effective Exchange Rate (REER) Approach; and the External Sustainability (ES) Approach.

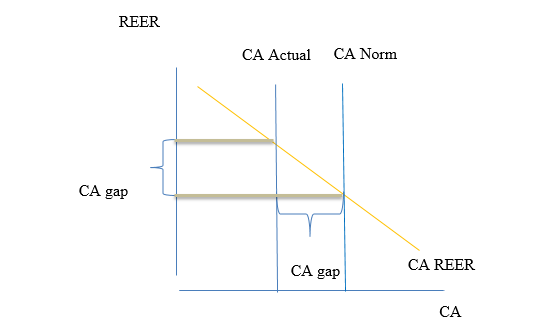

Graph 2. Representation of the intuition behind the EBA CA approach

The current account is an inverse function of the real effective exchange rate. In other words, when the real effective exchange rate goes down, the current account goes up, and vice versa. The vertical line designates the long run current account norm and the point of intersection between the actual current account and the current norm determines the level of the exchange rate consistent with fundamentals. In fact, in practice, these two variables rarely coincide.

If actual current account is lower than the current account norm, as is the case in this graph, difference between the two of them is going to be the current account gap. Since the actual current account is lower than the normative current account, it means that the exchange rate needs to depreciate to take the actual current account to a value equal to the norm. This means that the exchange rate is overvalued.

Then, the difference between the level of the real effective exchange rate that is consistent with the actual current account and the level of the exchange rate consistent with the current account norm is going to be the real effective exchange rate gap. In the graph above, it indicates that there is an overvaluation. The value of the current account norm is very important at the time of determining the degree of exchange rate misalignment. If the current account norm was further out from the actual current account, this could mean that the exchange rate gap would be higher and this would indicate a higher degree of exchange rate over valuation.

The current account (CA) approach

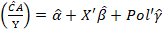

The EBA CA approach consists of four steps. The first step focuses on the estimation of the relationship between the current account balance and a set of fundamental variables based on some concepts: the fitted value of the CA, the CA norm, and policy gaps. The economic intuition behind the variables used to estimate the CA regression and calculate the fitted value of the CA. Estimate regression for the CA balance:

CAY=α+X'β+Pol'γ (2)

(2)

Where,

- CAY

is the relationship between the current account divided by GDP

is the relationship between the current account divided by GDP - In the vector X, in another side of equation, a set of fundamental variables are included

- vector Pol include policy variables

- alpha is going to be a constant

Regarding above formula, first of all to note that, it includes macroeconomic fundamental variables and policy variables in the regression estimate for the current account balance. But in theory, cyclical components such as output gap, terms of trade to be included in the regression. The cyclic component determines the effect of output gap and trade conditions (export-import price ratios) on the predicted CA in the regression. In addition, the writing of the regression equation, the ε reflects the residues with normal distribution.

In above equation (2) In the first step, the relationship between the current account divided by GDP on a set of fundamental variables that are included in the vector “X”, and policy variables that are included in the vector “Pol”, and Alpha is going to be a constant. The estimation is done using a panel that consists of 49 countries and the time period is 1986 to 2013. The “current account over GDP hat” denotes the predicted or fitted value of the current account.

It includes the macroeconomic fundamental variables used for example, GDP growth expectations, what indicators are included as net foreign assets, policy variables (for example, fiscal balance as a policy change, or public health spending or foreign exchange intervention, which policy variables are included). We think the names of the cyclic variables to be included. And this will be given as deviation from the model made by author in the following chapter.

The current account and the real effective exchange rate are, by definition, measured relative to other countries, so cannot be determined only by a countries' own characteristics and must reflect, foreign characteristics. This is the reason why all the variables are measured as the domestic country relative to the rest of the world. From this regression, the coefficients of beta and gamma are obtained indicating how the current account varies in response to each of these variables.

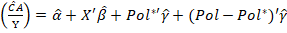

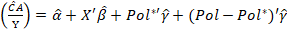

Decompose CA norm and policy gaps contribution:

CAY=α+X'β+Pol*'γ+(Pol-Pol*)'γ (3)

(3)

We think, this equation determines the effect of output gap and terms of trade (ratio of export and import prices) on CA predicted in regression. The cyclic component is not reflected in the above regression equation.

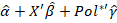

α+X'β+Pol*'γ

The expression is a cyclically adjusted (or more precisely, refined) CA norm.

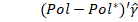

(Pol-Pol*)'γ

The expression is a political gap. In such case, the cyclic component variables on the right side of the equation 3 should also be included.

The fitted value of the current account over GDP can be decomposed in two terms. The first term is going to be the current account norm, which is going to be the current account in line with fundamentals and recommended level of policies, which are denoted by “Pol*” (Pol* - recommended/desired level of policy variables), which is the EBA norm.

The second term is the contribution of the policy gaps into deviations from the current account norm. The only thing here is to add and subtract the term “Pol*” times gamma into the first equation. Adding and subtracting a term from an equation basically yields the same result.

CAY=α+X'β+Pol*'γ+(Pol-Pol*)'γ (4)

(4)

|

Contribution of Policy gaps into deviation from CA norm |

|

EBA CA norm (CA predicted at Pol*) |

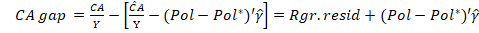

Current Account Gap

The current income gap is the difference between the actual current account and the current account norm. Total CA gap:

CA gap =CAY-CAY-(Pol-Pol*)'γ=Rgr.resid+(Pol-Pol*)'γ (5)

(5)

|

Contribution of Policy gaps |

|

EBA CA norm |

|

Actual CA |

To calculate it, from the actual current account over GDP, for example in the year 2014, to subtract the value of the current account norm. As shown in previous formula, the term EBA grant account norm is obtained from subtracting from the fitted value of the current account the policy gap.

The difference between the actual level of the current account and the fitted value of the current account, (it's the difference between the current account over GDP and current account over GDP hat), is the regression residual or the policy gap, which remains the same.

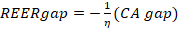

Real Effective Exchange Rate Gap

To compute the real effective exchange rate gap by multiplying the current account gap, but by 1 (one) divided by the negative of the current account elasticity:

REERgap=-1η(CA gap) (6)

(6)

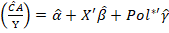

To compute the fitted value of the current account, first, to estimate this regression below and obtain the coefficients beta and gamma. Regression for the CA balance is:

CAY=α+X'β+Pol*'γ (7)

(7)

In the policy gaps sheet in Excel-based EBA framework shows the estimation results for the current account regression for Azerbaijan. The coefficients from the estimation of the current account regression are obtained from a panel regression. To note that, this include only a small number of variables, but there are many more which are part of the equation,

On non-policy variables, the current account regression includes a country's log net foreign assets divided by GDP. Countries with positive net foreign asset position tend to have higher current account balance and this is because countries with higher net foreign assets receive higher income returns, and this implies higher current account balances.

Also possible that, countries with higher net foreign asset can afford to run larger current account deficits. The current account regression also includes some demographic variables, such as the old age dependency ratio. In theory, countries with higher shares of dependent population generally have lower savings. Therefore, lower current account balances and respectively a negative value in the coefficient, which is in line with the theory.

Another demographic variable included is population growth, which captures the larger shares of young population and also linked with lower current account balances because it implies lower savings so is a negative coefficient as well.

The current account regression includes a variable which captures the expected GDP growth rate five years ahead. Economies with faster growth tend to invest and consume more and, therefore have less positive current account balances.

The coefficient here is negative, and implies that an increase in the relative forecast growth rate by one percentage point is associated with a reduction in the current account of almost a half percentage point of GDP.

On the policy variables, the first is the lagged public health spending divided by GDP, which is a type of social protection policy which may influence the national savings rate. Evidence suggests that social protection tends to reduce household's need for precautionary savings and therefore, the estimation coefficient is negative. Lower savings are associated with more negative current account balances.

Fiscal policy is measured as the cyclically adjusted budget balance. A higher fiscal balance implies higher savings. Recall that savings are composed by both private and public savings, then this would lead to a higher level of the current account and have a positive co-efficient.

Finally, to obtain the fitted value of the current account, to multiply each coefficient by the value of each variable and each variable is expressed with respect to the rest of the world. To add them all up, including the other factors, the fitted or predicted value of the current account is obtained. The difference between the actual value of the current account and the predicted value is the unexplained residual.

- Calculation of the policy gaps

The policy gaps are composed by the difference between the current policy and the recommended or desired policy variable of a country with respect to the rest of the world, denoted by W. For the fiscal policy gap, the fiscal balance is taken for the domestic country and the gap is denoted by P minus P star. World policy gap also denoted as the difference between the current value of the policy variable and the recommended or desired policies. The total gap is going to be the difference between the domestic and the world policy gap. For example, if domestic fiscal policy gap is minus 2.2% it means that the fiscal balance is lower than the recommended value of P star by 2.2%. This implies that the excessively loose domestic fiscal policy is contributing to a lower current account balance.

In order to get the contribution of the total gap to the current account, first to calculate the total gap which is the domestic gap minus the world gap. Then multiply the value of the total gap, by the value of the coefficient gamma. To obtain the total policy gap contribution, to add the contribution of the individual policy gaps.

EBA CA approach focuses on the calculation of the CA norm which means the CA is in line with fundamentals and recommended level of policies.CA norm is the difference between the predicted current account and the total policy gap contribution. This value of the current account norm is used to calculate the degree of exchange rate misalignment. The real effective exchange rate adjustment would close the current account gap so that the observed current account converges to the current account norm.

A negative current account gap, and therefore the positive real effective exchange rate gap, implies that the real effective exchange rate is overvalued. This means that the exchange rate needs to depreciate to actually take the actual current account closer to the current account norm (See graph 1 above).

REER approach

To estimate the REER regression, first have to calculate the predicted REER. Second step to calculate the policy gaps and the total REER gap and then provide an assessment of the degree of exchange rate misalignment. The difference is that here the real effective exchange rate is used as an explanatory variable, but the regressors are similar to the ones in the current account regression.

REER gap = REER - [REER – (Pol – Pol*)’Ý] (8)

Another difference is that the real effective exchange rate regression excludes the cyclically adjusted budget balance and includes the interest rate differential as an indicator of monetary policy. To compute the fitted value of the real effective exchange rate, the first, have to obtain the coefficients beta and gamma.

The real effective exchange rate regression includes their real interest rate differential interacted with capital account openness. And this is relative to the trading partners as a weighted average and the variables are also with respect to the rest of the world. In the real effective exchange rate regression, the rest of the world is defined as trading partners.

This variable is used to capture the impact of monetary policy on the real effective exchange rate. A higher interest rate would lead to higher capital inflows, which will generate more appreciated exchange rate. For example, a one percentage point increase in the relative real short-term interest rate would be associated with appreciation in the real effective exchange rate in countries with open capital accounts.

The real effective exchange rate regression also includes private credit divided by GDP for the domestic country relative to the trading partners. An increase in credit would boost domestic demand, worsen to current account, and appreciate the real exchange rate.

On the non-policy fundamentals the regression includes the expected GDP growth in five years relative to the trading partners. An increase in growth would be associated with higher capital inflows, and therefore, lower current account balances and more appreciated exchange rates.

External Sustainability Approach

The third EBA method to analyze exchange rate misalignment is called external sustainability approach. In contrast to the other methods, this method is based on an accounting identity and not on regressions and consists of two steps. The first step consists on calculating the current account balance that would stabilize the net foreign asset position of a country at some benchmark level. This could be the level of last year, an average, a target and give a current account norm.

And the second step consists on using the actual current account and the elasticities, as we did in the current account approach, to generate the real effective exchange rate adjustment that over the medium term would bring the current account balance in line with the net foreign asset stabilizing current account balance.

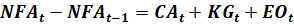

The net foreign assets at time T of a given country minus the net foreign assets at time T minus 1 is going to be equal to the current account at time T plus the capital gains from valuation changes plus the errors and omissions:

NFAt-NFAt-1=CAt+KGt+EOt (9)

(9)

|

KA transfers, errors/omissions |

|

Capital gains from valuation changes |

To make it clearer, it should be noted that net foreign assets are residual at the end of period t, there is no flow. That is, it is like a stock, not a flow. Because it is a flow statistic in the balance of payments. The balance of payments also reflects NFA flow statistics according to the 6th edition of the BOP. However, the left side of the regression equation is the residual and the right side is the flow statistics.

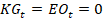

Assume, for simplicity, that capital gains and errors and omissions are zero:

KGt=EOt=0 (10)

(10)

We would like to note that this is an theoretically ideal approach, where error and omission are zero. In practice, this is never the case. This error makes it impossible for the omission to be zero. Capital gains that affect the amount of foreign assets as a result of the revaluation are also almost non-existent in practice. This assumption has been made to simplify the matter. In this case, the results obtained are then interpreted in terms of the hypothesis in equation 10.

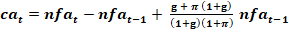

Then if to rewrite this identity in terms of GDP, we get the following equation: g

cat=nfat-nfat-1+ g + π 1+g1+g1+π nfat-1 (11)

(11)

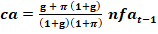

To sum up, the lower caps are going to indicate that the variables are with respect to GDP. And here the g is going to be the growth rate and pi is going to be inflation. To keep the net foreign asset stable over time, that this is going to take a value of NFA bar. Then the current account norm:

ca=g + π 1+g1+g1+π nfat-1 (12)

(12)

In the last step of the current account approach to compute the current account gap and real effective exchange rate gap stabilizing the net foreign assets with respect to GDP benchmark. To remember that a negative current account gap and a positive real effective exchange rate gap indicate an overvaluation.

According to the EBA framework, if the value of the real effective exchange rate gap is between minus 5% and 5%, then it means the real effective exchange rate is broadly in line with fundamentals. If it is between minus 5% and minus 10%, or between 5% and 10%, we say that it is moderately misaligned.

To sum up exchange rate appreciate stimulates imports and leads to a deterioration in the current account. Similarly, an exchange rate depreciation stimulates exports and leads to an improvement in the current account. The current account and the exchange rate are usually related and it is important to understand whether the exchange rate is correctly valued.

The IMF EBA framework is applied to evaluate whether the exchange rate is broadly in line with fundamentals and this tool allows to assess the degree of exchange rate misalignments. There are indirect methods that focus on the current account and there is a direct method that focuses on the real effective exchange rate. To note that, the EBA result put the appropriate current account norm at about 4% deficit of GDP. That's a large deficit.

5. DATA

Implementing the probabilistic approach in the model requires a reasonably long historical data series to conduct estimations. To note that, estimations for Azerbaijan in this article 25 years (1995-2019) of BOP and Net International Investment Position (NIIP) data were required at annual frequency. . The CA regression model and estimated coefficients have the expected signs, and nearly all are statistically significant. In other words, regressors are given in four groups: Productivity/level of development (interacted with capital account openness); Expected GDP growth rate 5 years ahead; Relationship with NFA position; Exhaustible resources of oil and natural gas.

To note that data set includes demographics, share in world reserves, K openness, GDP growth forecast, trade openness, institutional index, output gap, credit and credit growth, public health expenditure, migrant share et c. Traditional CA regressions reflect the theory that capital will flow from higher- to lower-productivity economies, according to the extent to which an economy is “behind the economy at the frontier” of highest productivity. This theoretical expectation can only occur to the extent that policies permit capital to flow across countries; the EBA regression therefore includes an interaction with a measure of capital account openness. World Bank WGI index also used to identify comparators for countries based on their WGI score.

6. RESULTS

- The results of EBA-Lite regression-based model

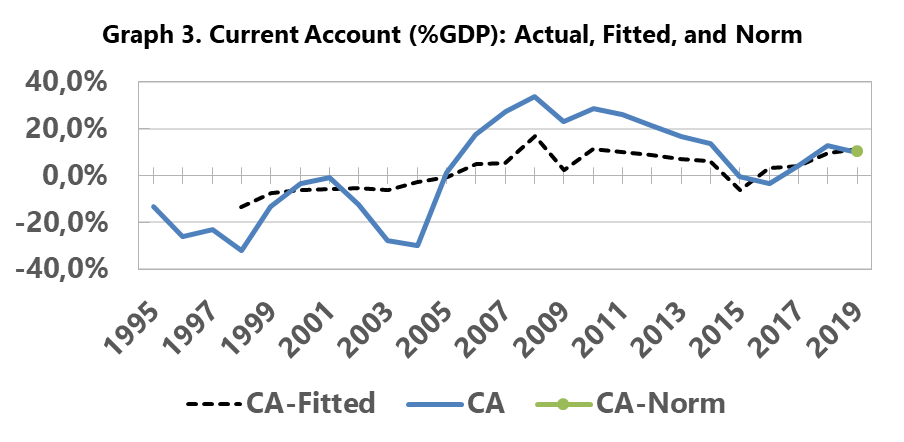

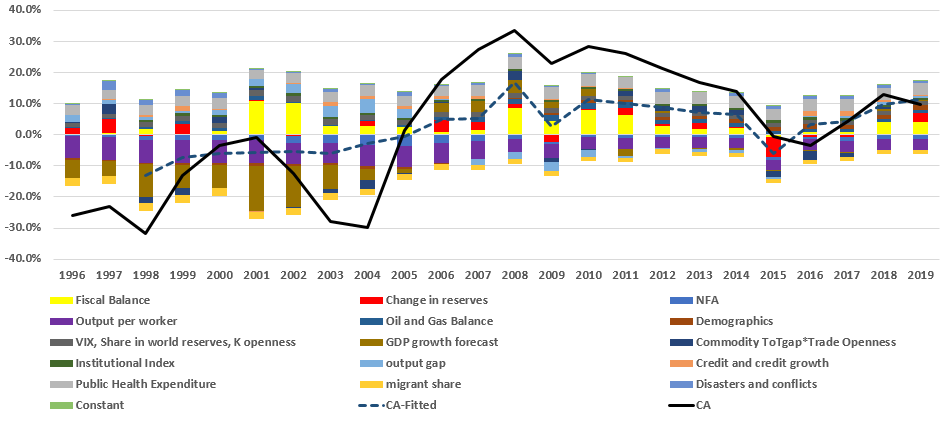

CA and REER gaps analysis of 2019 year, shows that most of the CA norm’s explanatory variables do not change that much. The consumption-based allocation model[5] suggests the CA norm of 14.2 percent of GDP for Azerbaijan measured at constant real per capita annuity, whereas the EBA-lite CA methodology suggests 13.3 percent of GDP. However, clearly the lower oil price and NFA, widening fiscal deficit, and lower productivity decreased the CA norm in 2019. Preliminary results imply that, if financial deepening happens, then the private credit level[6] could be above the current levels and this improvement will lead to healthier financial sector. On fiscal policy[7], it is needed to pursue fiscal consolidation given oil dependency and long run oil depletion. From this perspective, whatever the actual cyclically fiscal balance, we need to assume a desirable policy would have an even better (more of a surplus in 2019).

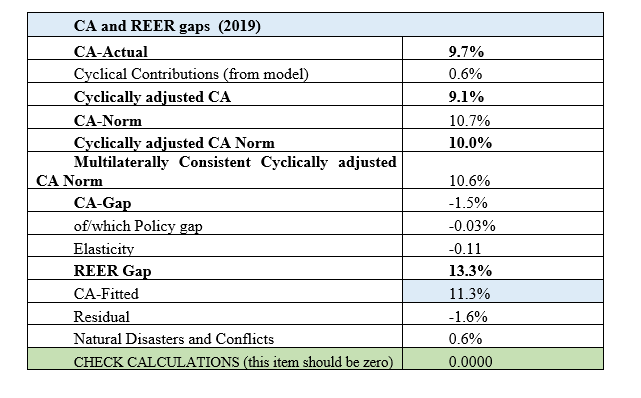

Below are the summary sheet of 2019 CA and REER gap results for Azerbaijan based on IMF EBA-lite methodology. One key observation is that both have CA-actual value lower than the CA fitted value. This means that the regression is producing a CA estimate higher than the actual, and that means a real exchange rate is overvalued. In 2019 CA gap is (9.7-11.3 = -1.6).

Table 1. CA and REER gaps for Azerbaijan for 2019 year.

If we take out the cycle components and policy gaps, then CA gap shrinks. In 2018 the gap goes to -1.7. However, in 2019 these adjustments actually make the gap slightly higher which suggests that REER is overvalued. It should be noted that both of these results are within normal error bands, and appear to suggest that they are relatively close to fundamentals in both cases. 2020 year results will probably be different given the sharp drop in oil prices.

Finally, the importance is to look at the individual contributions to the estimated CA norm (regression variables). The CA fitted value went from 16.4 in 2018 to 11.3 in 2019. It is important to understand what has changed and why. For example, we note that NFA series[8] has changed dramatically and this may be due to how we changed the definition of debt (taking out the guarantees) or it could be due to much larger NFA growth in the rest of the world given very strong equity markets in 2019. It could be investigated separately. It is possible that the NFA values should be positive and larger, meaning the CA norm would be bigger and then the results would be back to being more overvalued.

Graph 4. CA: Contributions to Fitted Values

2020 actual CA projection is for a deficit of 5.0 of GDP and preliminary assessment is that the REER is overvalued by about 20-30 percent. To sum up, the results of the EBA-lite regression-based model point to overvaluation of the manat.

- Real Exchange Rates in Developing Countries

The well-known analyses of Balassa (1964) and Samuelson (1964) provide an explanation of the long-run behavior of the real exchange rate in terms of the productivity performance of traded relative to nontraded goods. The basic argument is that as the productivity of traded goods rises relative to that of nontraded goods, there will be a tendency for the real exchange rate to appreciate and Balassa-Samuelson effects are generally to be the key source of observed cross-sectional differences in real exchange rates (i.e., the same currency prices of comparable commodity baskets) between countries at different levels of  income per capita [1].

income per capita [1].

C. Determination of the equilibrium real exchange rate in Azerbaijan

The external position improved in 2019 on higher oil prices and lower oil-related services imports. Despite a large CA surplus, the external position is moderately weaker than implied by fundamentals and desirable policies. External stability risks are mitigated by sizable FX reserves.

The CA and REER tend to move with oil prices. After a decade of double-digit CA surpluses, the oil price shock of 2014–15 led to a sharp deterioration in the CA. A recovery in oil prices in 2017–19, coupled with a reduction in oil-related construction and business services (as many projects were completed), led to a rebound of the CA to a surplus of 4.1 and 12.9 percent of GDP in 2017 and 2018 respectively. To note that CA surplus made 9% of GDP in 2019 but could turn into a deficit of 8% of GDP with average oil price of 35 US dollar per barrel. The nonoil CA balance, however, continued to worsen in 2020 given a marked increase in nonoil imports and meager growth in nonoil exports. In the near term, the overall CA surplus is expected to decline to about 10 percent of GDP as oil prices moderate and the impact of the recent appreciation of the REER kicks in.

Despite sizeable CA surplus, the external position appears to be moderately weaker than implied by fundamentals and desirable policy settings. The assessment is based on the EBA-Lite methodology, which uses regression estimates of CA and REER norms and gaps. Norms are the estimated levels of the CA based on underlying fundamentals, while gaps are the deviations of observed values from the norms. To predict the equilibrium of the CA consistent with structural and policy factors, EBA-Lite uses regression analysis for a large sample of countries. Policy changes that would reduce the external gap over the forecast period include: (i) deeper fiscal consolidation to strengthen long-term fiscal sustainability benchmarks (additional 3.3 pp of nonoil GDP increase in NOPB to -23 percent of nonoil GDP by 2024, mainly through improvements in the efficiency of spending)); (ii) higher public health expenditure (an increase of about 1 pp of GDP to 2.3 percent of GDP by 2024 to get closer to the EM average of 3.5 percent of GDP, accompanied by improvements in the efficiency of healthcare spending); and (iii) financial deepening (for bank credit to the private sector to reach the level of 18 percent of GDP, accompanied by improvements in bank supervision and regulation).

7. CONCLUSION

The results of the EBA-lite regression-based model point to overvaluation of the manat. The bottom-line assessment of the external position is sensitive to assumptions.

Assuming no policy gaps, the CA and REER gaps would be -1.5 percent of GDP and 13.3 percent respectively, suggesting weaker external position than implied by fundamentals. Financial deepening and higher healthcare spending lower the CA norm. The intuition is that public health expenditure is akin to a social protection policy that discourages precautionary saving. If the need for additional fiscal consolidation were the only assumed policy gap, the estimated CA and REER gaps of -1.5 percent of GDP and 13.3 percent respectively, points to a weaker external position. Azerbaijan needs to bring its level of healthcare spending closer to EM average over the medium term, and promote financial deepening.

Drawing on the existing literature, this study estimates a long-run equilibrium real exchange rate path for Azerbaijan. The main conclusion is that REER movements in Azerbaijan can be explained by fundamental variables. The long-run real exchange rate of Azerbaijan is time-varying, and dependent on movements in relative productivity and real oil prices in line with EBA lite model. Deviations of the real exchange rate from its equilibrium level are adjusted fairly rapidly.

Furthermore, the analysis shows that the REER was not misaligned. Model-derived estimates of the long-run equilibrium real exchange rate replicate most recognized periods of currency overvaluation in Azerbaijan. The estimates support the conclusion that an appreciation in 2019 were consistent with developments in its fundamental determinants.

The results of this study have important implications for Azerbaijan’s exchange rate policy. Although Azerbaijan should continue with a managed float, targeting a constant REER over a prolonged period is not warranted as such a policy does not accommodate real shocks by allowing the nominal exchange rate and/or relative prices to move. Exchange rate policy should be directed to align the real exchange rate with its fundamental determinants, namely relative productivity and real oil prices.

REFERENCES

- BALASSA, B., 1964, “The Purchasing-Power Parity Doctrine: A Reappraisal,” Journal of Political Economy, Vol. 72.

- CASHIN, P., L. CÉSPEDES, AND R. SAHAY, 2002, “Keynes, Cocoa, and Copper: In Search of Commodity Currencies,” IMF Working Paper 02/223 (Washington: International Monetary Fund).

- CÉSAR CALDERÓN, ALBERTO CHONG, AND NORMAN LOAYZA. “Determinants Of Current Account Deficits In Developing Countries”

- CHEN, Y. AND K. ROGOFF, 2002, “Commodity Currencies and Empirical Exchange Rate Puzzles,” IMF Working Paper 02/27 (Washington: International Monetary Fund).

- CLARK, P., AND R. MACDONALD, 2000, “Filtering the BEER: A Permanent and Transitory Decomposition,” IMF Working Paper 00/144 (Washington: International Monetary Fund).

- CHOUDHRI, E. U. AND M. S. KHAN, 2004, “Real Exchange Rates in Developing Countries: Are Balassa-Samuelson Effects Present?” IMF Working Paper 04/188 (Washington: International Monetary Fund).

- DICKEY, D. AND W. FULLER, 1981, “Likelihood Ratio Statistics for Autoregressive Time Series with a Unit Root,” Econometrica, Vol. 49.

- DORNBUSCH, R., 1982, “PPP Exchange-Rate Rules and Macroeconomic Stability,” Journal of Political Economy, Vol. 90. No. 1.

- EDITED BY JOHN EATWELL, MURRAY MILGATE, AND PETER NEWMAN “Purchasing Power Parity,” in The New Palgrave: A Dictionary of Economics, (London: MacMillan; New York: Stockton Press).

- EDISON, H. AND W. MELICK, 1999, “Alternative Approaches to Real Exchange Rates and Real Interest Rates: Three Up and Three Down,” International Journal of Finance and Economics, Vol. 4. p.6.

- ENGLE, R. F AND C. GRANGER, 1987, “Co-integration and Error Correction: Representation, Estimation and Testing,” Econometrica, Vol. 55. p.14

- EDWARDS, S., 1989, Real Exchange Rates, Devaluation and Adjustment: Exchange Rate

- FROOT, K. AND K. ROGOFF, 1995, “Empirical Research on Nominal Exchange Rates,” in Handbook of International Economics, Vol. 3, edited by G. Grossman, and K. Rogoff (Amsterdam: Elsevier). P.48.

- GUSTAV, C. (1918). Abnormal deviations in international exchanges. The Economic Journal, 28, p. 413-415

- IMF Occasional Paper No. 165 (Washington: International Monetary Fund).

- IMF, (2013). “The External Balance Assessment (EBA) Methodology,” IMF Working Paper 13/272.

- IMF, (2016). “Methodological Note on EBA-Lite,” IMF.

- IMF, (2019). “The Revised EBA-Lite Methodology,” IMF.

- International Monetary Fund, 1998, “Algeria: Stabilization and Transition to the Market,”

- JOHANSEN, S., 1995, Likelihood-based Inference in Cointegrated Vector Autoregressive Models (Oxford: Oxford University Press).

- KHAN, M. S. and J. Ostry, 1991, “Response of the Equilibrium Real Exchange Rate to Real Disturbances in Developing Countries,” IMF Working Paper 91/3 (Washington: International Monetary Fund).

- LEE, J., G. MILESI-FERRETTI, J. OSTRY, A. PRATI, AND L. RICCI, 2008, “Exchange Rate Assessments: CGER Methodologies,” IMF Occasional Paper 261

- MARCHETTINI, D. AND RODOLFO MAINO, 2015. "Systemic Risk Assessment in Low Income Countries; Balancing Financial Stability and Development," IMF Working Papers 15/190.

- MEESE, R., AND K. ROGOFF, 1983, “Empirical Exchange Rate Models of the Seventies: Do They Fit Out of Sample?” Journal of International Economics, Vol. 14.

- MONTIEL, P. AND J. OSTRY, 1991, “Macroeconomic Implications of Real Exchange Rate Targeting in Developing Countries,” Staff Papers, Vol. 38, No. 4 (Washington: International Monetary Fund).

- POLICIES IN DEVELOPING COUNTRIES (Cambridge, Massachusetts: MIT Press)., 1994, “Real and Monetary Determinants of Real Exchange Rate Behavior: Theory and Evidence from Developing Countries,” in Estimating Equilibrium Exchange Rates, edited by J. Williamson (Washington: Institute for International Economics).

- ROGOFF, K., 1996, “The Purchasing Power Parity Puzzle,” Journal of Economic Literature, Vol. 34.

- SAMUELSON, P., 1964, “Theoretical Notes and Trade Problems,” Review of Economics and Statistics, Vol. 46 (May).

- TAYLOR, A., 2001, “Potential Pitfalls for the Purchasing Power Parity Puzzle? Sampling and Specification Biases in Mean-Reversion Tests of the Law of One Price,” Econometrica, Vol. 69, No. 2.

- TAYLOR, M. AND D. PEEL, 2000, “Nonlinear Adjustment, Long Run Equilibrium and Exchange Rate Fundamentals,” Journal of International Money and Finance, Vol. 19, No. 1.

- WILLIAMSON, J. (1985). The Exchange Rate System.Policy Analyses in International Economics, Vol.5. Washington, Institute for International Economics Cline

- WEI Y., BALASUBRAMANYAM V., 2015. A comparative analysis of China and India’s manufacturing sectors. Lancaster University, Department of Economics, Lancaster Working papers, 30p

Xammal ixrac edən ölkələrdə real effektiv məzənnənin tarazlığı: Azərbaycan təcrübəsi

Təqdim olunan Azərbaycan təcrübəsi, resursla zəngin iqtisadiyyatda valyuta məzənnəsi siyasətinin adekvatlığını tədqiq etməyə xidmət edir[9]. Bu məqalədə Azərbaycanın tədiyyə balansının son iyirmi ildəki dinamikası təhlil edilmişdir. 2015-ci ildə neft qiymətlərinin aşağı düşməsi valyuta məzənnəsini dayanıqsız etməklə əhəmiyyətli dərəcədə devalvasiyaya səbəb oldu. Sonrakı dövrdə cari hesab balansı tarazlaşsa da, gözləniləndən daha az səviyyədə oldu. Bu səbəbdən bölmədə EBA-Lite metodu ilə regresiya əsaslı qiymətləndirmə apararaq, real valyuta məzənnəsinin tarazlığı və uyğunsuzluqları məhz “siyasət boşluqları” (policy gap) ilə əlaqələndirilməklə təhlil olunub. Nəticələr göstərir ki, 2015-ci ildəki devalvasiyadan bir neçə il sonra Azərbaycan valyutası yenidən dəyərindən artıq məzənnəyə (overvaluaed) malikdir. Bundan əlavə, real məzənnə tarazlığı dəyişkən olub, uzunmüddətli sabit məzənnə ilə uzlaşmır. Valyuta məzənnəsi siyasəti nisbi məhsuldarlıq və real neft qiymətləri kimi əsas təyinedicilərdəki (fundamental determinants) dəyişiklikləri təmin etməyə xidmət etməlidir.

[1] Professor of Economics at the Public Administration Academy under the President of Azerbaijan, +994503328466, qasimlivusal@yahoo.com

[2] PhD student at the Institute for Scientific Research on Economic Reforms of Ministry of Economy of the Republic of Azerbaijan, +994503572276, vusala.jafarova@ereforms.gov.az

[3] CEIC(Census and Economic Information Center) generates Real Effective Exchange Rate Index with base 2005=100. The Central Bank of the Republic of Azerbaijan provides Real Effective Exchange Rate Index with base December 2000=100.

- [4] «Determinants of current account imbalance in the global economy: a dynamic panel analysis”. Debasish Kumar Das, Journal of Economic Structures volume 5, Article number: 8 (2016)

[5] Consumption-allocation commodity module developed by Bems and Carvalho (2010), examines annuity payments that are kept either at a constant real annuity or a constant real per capita annuity. The latter is the preferred measure, as it ensures that each person in each generation is allocated the same real resources out of the country’s wealth.

[6] See F10 Excel file, Policy gaps sheet

[7] See F7 Excel file, Policy gaps sheet

[8] (See the excel file, CHARTS tab)

[9] Bu bölmə COVİD-19 pandemiyasından əvvəl hazırlanıb.

Çox oxunan xəbərlər

Yerin təkinin geoloji öyrənilməsi və mineral xammal bazasından səmərəli istifadəyə dair Dövlət…

Azərbaycan-İran münasibətləri: keçmişdən gələcəyə doğru

İİTKM-də hava daşımaları üzrə rəsmiyyətin sadələşdirilməsinə dair ilk görüş keçirilib

İİTKM-də “GIS-Tech Marathon 2025”in qaliblərinin mükafatlandırılması baş tutub

"Azexport” portalı AzTU-da “Beynəlxalq elektron ticarət platformaları və rəqəmsal dünyada…

Bakı Dövlət Universitetində "Startup School 3" layihəsi çərçivəsində infosessiya…

“Enterprise Azerbaijan” portalının əməkdaşları Stanford Universitetinin professoru ilə görüşüblər

İİTKM Türk dövlətlərinin investisiya gücündən bəhs edəcək yeni kitab layihəsinə start verib

İİTKM-in şöbə müdiri Daşkənddə keçirilən beynəlxalq konfransda təqdimatla çıxış edib

“Startup School 3” layihəsi müzakirə edilib