Twin deficits in Armenia

Comments by Center for Analysis of Economic Reforms and Communication

The reduction of private and public income in the light of declining economic growth in Armenia facilitates fiscal and external sector imbalances. Twin deficits prevailing in the Armenian economy - budget deficit and current account deficit are expected to remain in the medium and long-term.

Budget deficit. The sharp economic contraction in the second quarter of this year (13.7%), pandemics and the escalation in the Nagorno-Karabakh conflict have negatively affected the fiscal balance of the country and have put general government debt on a high trajectory.

Budget revenues significantly deviated from the planned indicators. It was mostly driven by lower customs duty and profit taxes in January-August 2020 that declined by 6% compared to the last year. The revised official forecasts show 6.8 % reduction in GDP and tax revenues while military and healthcare spending rises.

Armenia has exceptionally high infection per capita rate, thus the fiscal balance of the country is strongly affected by the pandemics. In line with the region countries, a budget envelope was implemented in 2020 around 4% of GDP. Projected to be 10 percent of overall public spending in 2020 before the onset of the COVID-19 pandemic, the health expenditures are expected to be higher.

Meanwhile, the military spending is increased in 2020 budget. As reported by the U.S. Central Intelligence Agency, the country spends about 5% of its GDP annually on military (10% according to Global Fire Power). Conditioned with the current military situation in Armenia, these expenses with little fiscal multiplier effect may rise and further tighten the fiscal space for infrastructure investments and social expenditures in Armenia.

Despite the pension reforms, pension system remains ineffective and creates additional burden to the budget deficit. Low productivity, aging population and high emigration rate deepens this problem. According to UN, Armenia is expected to have an old-age dependency ratio of around 17.5 percent and 34.3 percent in 2020 and 2050 accordingly. EU estimates the financial sustainability of the pension systems to deteriorate on average by 4.6% of GDP between 2020 and 2050. The youth emigration from Armenia adds more to this issue. The average net migration rate for 1990-2015 was -11.8

The national debt in Armenia has increased by 8.8% in January-August, exceeding $ 7.97 billion. The domestic debt jumped by 24.3% to $ 1.9 billion by September 2020. Fitch considers that there is a substantial uncertainty regarding the potential to implement a fiscal consolidation program as additional fiscal measures would be needed to support weakening GDP. The ongoing war and worsening situation with pandemic puts downside risk to fiscal projections of Armenia.

To supplement the under-execution of revenues and the budget deficit more than doubling in July, the government revised the budget deficit. According to the official forecasts the budget deficit of Armenia is projected to reach 7.4% of the GDP by the end of 2020 and will be covered by attracting debt increasing the ratio of debt to GDP to 67% in 2020. Fitch forecasts the government debt to remain elevated over the medium term.

Current account deficit. External vulnerabilities of Armenia including net external debt, large structural current account deficit, weak FDI inflows and high dependency on remittances prevailed in 2020. The trade is challenged and the attractiveness of the country for foreign investment is halted due to cross-border integration and transportation problems, restrictions of the access to markets, underdeveloped infrastructure and prevailing corruption despite the measures taken against it. Borders with neighboring countries are either closed due to political reasons, or offer limited opportunities and the Nagorno-Karabakh war has escalated with Azerbaijan. In October 2020 Fitch Ratings has downgraded Armenia's Long-Term Foreign-Currency Issuer Default Rating (IDR) to 'B+' from 'BB-'. The country's debt service costs is expected to increase.

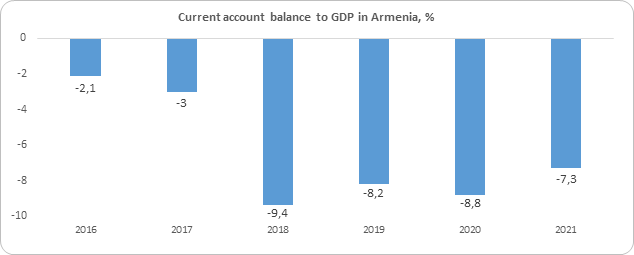

Armenia's current account deficit to GDP ratio is 8.2%. This deficit prevailing since 1991 is chronic in nature.

Source: IMF

According to the official data, in January-August 2020 compared to the same period of the previous year, external trade turnover, imports and exports decreased by 10.2 %, 12.4% and 6% accordingly. In Armenia export has low diversification rate in terms of both goods and destinations. The low value-added manufacturing goods and primary commodities dominating the export basket limits external competitiveness. Metals and precious stones make approximately half of the exports. Export of mining products is one of the main sources of foreign currency, exposing the economy to volatility in global commodity market prices due to pandemic. Agricultural products make about 30% of the overall export and are affected by the labor constraints strengthened by emigration and ongoing militarization. The import dependency for food and other vital consumer goods is deepening. 5% depreciation of the bilateral dram exchange rate in March 2020, did not contribute to the increase of exports, but affected the prices of the imported goods which can be explained by the “dominant currency paradigm” as well. Country’s import dependency on fossil fuels puts additional pressure on the current account.

The reduction of imports was twice as big as the decline of the exports in 2020. The reduction is stemming from the drop in demand affected by low remittances. With 11 percent ratio to GDP, remittances considered an important and the most stable driver of GDP growth in Armenia as it supports the private consumption. According to Fitch, the external shocks in the wake of the coronavirus pandemic resulted the remittances in the first half of 2020 to fall 22% compared to the same period of the previous year. Russia is the primary source of remittances and one of the main trade partners for the country (accounts for about 30% of the exports and 25% of the imports of Armenia). The foreign currency inflows from Russia are highly affected by the oil price dynamics exposing Armenia to Dutch disease without being an oil exporter.

The current account deficit is expected to deteriorate further considering the fall in export demand, the collapse in tourism and weaker remittances. In October the IMF forecasts for CAB/GDP deficit in Armenia to be worsened to -8.8% GDP in 2020 and to -7.3% in 2021. The current account deficit is expected to moderately widen in 2021-2022 affected by the domestic demand. According to Fitch, “less than one-third of the deficit is covered by non-debt creating capital inflows.

In the face of economic and political instabilities, it doesn’t look feasible to finance the current account deficit by attracting new foreign investment. FDI stock of Armenia is among the lowest in the region and in the recent years, they have been concentrated in the mining and energy sectors. Mining sector is dominated by a small number of large operators, making it vulnerable to external shocks. The government investigations in this area reduces investor confidence. Environmental issues constraints the operation of the mining companies such as Lydian İnternational in Amulsar mine. The country is isolated from big transportation projects in the region such as BTC and BTK due to territorial claims to Azerbaijan.

Projections about Armenia's financial account considers the withdrawal of deposits of non-residents as well. Thus, pressure on the national currency is on the rise. The inflation following the expected devaluation would increase poverty rates in Armenia. Besides, highly dollarized balance sheets expose banks to potential FX-related credit and liquidity risks.

Despite the commitment to the floating exchange rate regime, Central Bank of Armenia has been intervening to FX market to prevent dram devaluing further than 5% in March and April 2020. Limited international reserves constraints the Central Bank interventions to FX market. International reserves are about USD 2.7 billion at the end of August. Fitch forecasts FX reserves in 2022 at near 4.0 months of current external payments which is very close to the sufficiency limit. Only small percent of the reserves are liquid assets.

According to the official data of Armenia, in January-August 2020, the external debt grew by 4.7% and reached USD 6.1 billion by September 2020. The sources of the borrowings are not diversified which adds further to the risks in case of repatriations. The main share in the total amount belongs to investors from several international organizations and countries. Armenia has IMF budget support for 2020 that has been almost fully spent, EU grant funding and project funding from IFI. Fitch forecasted the net external debt of Armenia to increase to 57.6% of GDP at end-2022 from 47.3% at end-2019, well above the peer group median of 29.9% of GDP.” By the 31 august 2020, more than 76 percent of the government debt of Armenia is in foreign currency, which is vulnerable to exchange rate volatility.

Thus, a combination of suspended export industry, reduced money transfers from abroad, ongoing military operations, health crisis and unsustainable pension system facilitate the external and fiscal imbalances and widen the twin deficits. In its turn, this can lead to exchange rate volatility, fall in international reserves, higher cost of attracting new loans and rising foreign debt and interest burden.

Op-eds

Agil Asadov

Head of the Strategic planning division

"Azerbaijan-China Relations: Formation and Perspectives"

Isa Gasimov

Head of the “Enterprise Azerbaijan” portal

Social entrepreneurship is an important tool for economic sustainability

Vusala Jafarova

Head of the Turkic World Research Center

"Driving Economic Integration and Digital Transformation: Azerbaijan’s Strategic Leadership in the Organization of…

Vusala Jafarova

Head of the Turkic World Research Center

"Azerbaijan’s Admission to the D-8: Strengthening Economic Cooperation with Global Potential"

Vusala Jafarova

Head of the Turkic World Research Center

Turkic States Economic Outlook for the First Half of 2024: Growth, Trade, and Investment Trends

Agil Asadov

Head of the Strategic planning division

Moody's: Growing influence of the Middle Corridor boosts economic prospects

Vusala Jafarova

Head of the Turkic World Research Center

The Karabakh Declaration and the future of economic cooperation of the Turkic world