The 8th International Banking Forum (IBF) was held with the support of the Azerbaijan Banks Association, the Central Bank of the Republic of Azerbaijan, and the Center for Analysis of Economic Reforms and Communication.

Prof. Dr. Vusal Gasimli, Executive Director of the Center for Analysis of Economic Reforms and Communication delivered the opening speech at the forum.

Speech Transcript:

"Hello, ladies and gentlemen,

First of all, I would like to express my deep gratitude to the organizers of the 8th International “Reliable, Safe, and Sustainable” Banking Forum. This international forum provides valuable opportunities for the exchange of ideas and experiences in strategic areas such as banking and financial technologies, digitalization, payment ecosystems, and cybersecurity. Given the forum's agenda, the topics to be discussed in the panel sessions address current modern challenges. Therefore, today’s international forum, organized by the ABA, is particularly relevant and important.

As the name of the forum suggests, the panel discussions will focus mainly on the reliability, safety, and sustainability of the banking system.

Reliability

We are currently living in an era where traditional banking services are no longer sufficient. In an age of rapid digitalization, ensuring financial stability alone is no longer enough to gain consumer trust. At the same time, transparency, protection of consumer interests, and the application of high ethical standards are crucial to this process. To address this, the Central Bank has been implementing the "Complaint Index on the Use of Banking Services" since October 2023. This index is calculated based on the principle of proportionality, taking into account both the volume and scope of financial services provided, as well as the complaints received by the Central Bank regarding customer service in the banking sector. The index categorizes complaints into three levels: "high," "medium," and "low."

Graph 1:

Complaint Index of Bank Customers on the Use of Banking Services (January-October 2024)

This graph illustrates the dynamics of the complaint index for bank customers from January to October 2024. According to the data, the average monthly maximum coefficient of the complaint index was 4.45, while the minimum coefficient stood at 0.18. It is important to note that this index serves as a basis for improving the quality of banking services by measuring the problems encountered by consumers in connection with banking services and the intensity of these issues. This is clearly reflected in the graph."

.png)

Security

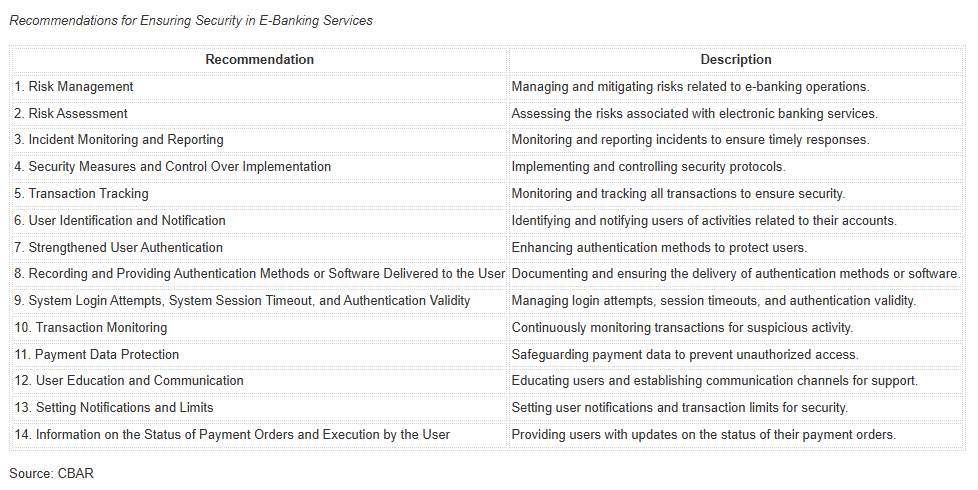

On the other hand, the adaptation of banking operations to cybersecurity standards and the management of risks in digital payment systems are also critical issues today. In particular, implementing security measures for the development of electronic banking and cashless payments is a priority. This step clearly demonstrates the state's support for cashless payments. In 2023, the number of transactions carried out through e-commerce in the country increased by 2.2 times, and their volume grew by 2.1 times. Additionally, the share of cashless payments made with payment cards increased by 12.4%, the volume of transactions carried out through Internet banking services rose by 12%, and the volume of mobile banking transactions doubled. It is not coincidental that, in 2016, by Presidential Decree, the "Strategic Roadmap for the Development of Telecommunications and Information Technologies in the Republic of Azerbaijan" was approved, followed by the approval of the “State Program for the Expansion of Digital Payments in the Republic of Azerbaijan for 2018–2020” in 2018. Furthermore, the Central Bank of the Republic of Azerbaijan regulates the provision and use of electronic banking services through its "Methodological Guidance on the Provision and Security of Electronic Banking Services." This document consists of 14 recommendations outlining the types of electronic banking services, rules for their provision, and security measures.

Table 1.

Source: CBAR

Sustainability

In 2023, the financial stability of the banking sector showed notable improvements, including an increase in both the total capital of the banking sector and credit activity. The total capital of the banking sector rose by 8% (417 million manat), reaching 5.6 billion manat. The loan portfolio of banks grew by 18.3% (3.6 billion manat) and amounted to 23.2 billion manat. The consumer portfolio increased by 20.6%, the mortgage portfolio by 21.6%, and the business portfolio by 16.2%.

Since the banking sector is a cornerstone of the national economy, sustainable banking requires the development of strategies that support ESG (Environmental, Social, and Governance) development. Banks can contribute to societal well-being by promoting green financing and sustainable projects. The recently approved “Green Taxonomy” document by the Central Bank is a timely step toward realizing the strategic goals of sustainable development and green transition in the financial sector. This document outlines a classification system for determining the types and subtypes of green activities, along with their technical criteria across various economic sectors. The taxonomy covers 10 sectors:

- Renewable Energy

- Energy Efficiency

- Sustainable Water Resources Management

- Pollution Prevention and Control

- Green Transport

- Sustainable Agriculture, Livestock, and Aquaculture

- Biodiversity Protection

- Circular Economy and Waste Management

- Green Buildings and Sustainable Construction

- Green Services

At the international level, green taxonomies are recognized as important tools for making the financial system greener and for directing financial resources to sustainable economic activities. In this regard, this document is of particular significance for promoting a consistent approach to sustainable finance and encouraging investments that contribute positively to environmental and sustainability goals.

We must also consider that our country places significant emphasis on environmental protection and mitigating the effects of climate change. The importance of this is reflected in the inclusion of “Azerbaijan 2030: National Priorities for Socio-Economic Development,” where “A Country of Clean Environment and Green Growth” is one of the five national priorities. Moreover, following a decree from the President, 2024 has been declared the “Year of Solidarity for a Green World.”